Planning Briefs

Omicron Variant: What It Means To Investors?

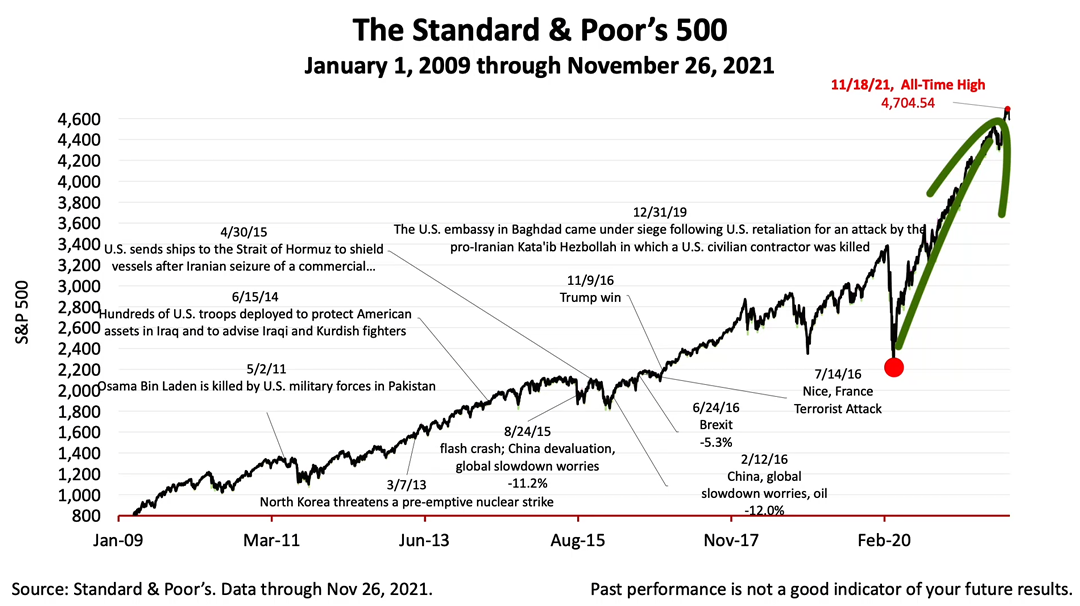

Since the Omicron variant was cited last Friday by the World Health Organization as a “virus of concern,” stock prices for the last three stock-trading days have gyrated.

The Standard & Poor’s 500 plunged -2.3% last Friday, and then rose +2% on Monday, before plunging again today by -1.9%. Tuesday’s plunge came after Federal Reserve Board Chairman Jerome Powell said Omicron posed new risks to the expansion.

The variant’s characteristics – its transmissibility, resistance to vaccines, and treatability -- are likely to continue to dominate the headlines over the next two weeks, which means even more volatility should be expected. But that doesn’t mean the bull market is over.

Since the Covid bear-market bottomed in late March 2020, stock prices have soared. And they continued soaring after the Delta variant in May unexpectedly stalled U.S. economic growth. Why?

It’s because yields on bonds are lower than ever before in U.S. history. This significantly changes the valuation investors historically attributed to stocks relative to bonds. This new valuation paradigm of stocks versus bonds is now in place and it must be understood before making investment decisions in this period of wild swings in stocks prices.

More bad news about the Omicron variant should be expected over the next two or, possibly, three weeks. The financial press is making the variant’s effects melodramatic and sensationalizing the situation.

“I think it’s a major moment,” The New York Times today quoted a hedge fund manager saying. “The Fed is finally sort of putting their stake in the ground and saying that the bubble has gone on long enough.” The financial press, even the best outlets, has a long history of sensationalizing major news events, like the Omicron’s effects on a long-term investor’s portfolio.

Bubble talk from speculators misleads individual investors about the financial economic situation. Please do not to let the headlines divert you from your strategic plan or long-term investment policy.

Which brings us to Reason Number Five clients trust our firm’s advice: We believe every investor should have a strategic investment policy to guide their portfolio through moments like this, when the unexpected happens.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Myles wealth management and is not intended as legal or investment advice.

©2021 Advisor Products Inc. All Rights Reserved.

More articles

- Special Report: Long-Term U.S. Equity Investments And Demographics

- Things Really Are Different This Time.

- Is A Market Melt-Up Under Way?

- An In-Depth Report For Investors On Key Economic Fundamentals

- What Secret Of Investing Is Revealed In This Picture?

- What Drives Stock Prices?

- Reason No. 7 To Hire A Financial Professional: Rebalancing

- A Framework For Investing For Life

- While Congress Must Deal With Debt Ceiling, Leading Economic Indicators Are At A Record High

- Negative Real Returns On Bonds Changes The Asset Valuation Paradigm

- A Crucial Investment Lesson From A Difficult 20 Years

- Is The Expected Income Tax Hike Going To Affect You?

- 2021 Year End Tax Planning: Higher Stakes And More Confusing Than Ever

- Making A Life-Changing Financial Difference To A Spouse And Needy Loved Ones

- Retirement Planning Alert For Current Financial Economic Circumstances