Financial Briefs

Email This Article To A Friend

Office Space Reckoning May Trigger Turmoil In Commercial Real Estate

Office-space delinquencies tripled in the first six months of 2023, and office-space landlords and investors through mutual funds, retirement plans, and other packaged products must be alert to the following:

Delinquencies on office-space mortgage loans averaged 10 times the other four subcategories of commercial real estate (CRE). Lodging, second worst of the five subcategories of U.S. CRE, in the first six months of 2023 experienced a 141% rise in delinquencies. That was bad, but only half the 3.1% delinquency rate on office-space mortgages. Comparatively, multifamily home, industrial production, and retail CRE delinquencies were fractional. Clearly, post-Covid America needs much less office space. With 46% of mortgages on office space maturing between 2023 and 2025, rates post-pandemic have soared and banks have tightened their loan standards in recent months.

These are some of the key observations of Erin McLaughlin, an expert on office-space and commercial real estate and senior economist at The Conference Board. In an October 11 presentation to corporate leaders at large companies, Ms. McLaughlin painted a grim outlook of the office-space segment of CRE.

Background. Office-space accounts for 18% of all U.S. CRE, McLaughlin said. Thus, the turmoil expected in CRE may be mostly contained to the office-space segment. Office space generally is mortgaged in variable rate loans with seven- to 10-year terms. The 18-month rise in lending rates that began in March 2021 is now hitting more office space landlords, who face tougher lending standards on top of higher borrowing costs. It’s harder to qualify for a mortgage on office space, and recapitalizing now is much more expensive.

Retrofitting office buildings into residential apartments is a pipe dream – literally. While converting CRE into residential housing sounds like a great idea, TCB’s research team says office-building windows, plumbing, and HVAC systems make it uneconomical. Only about 10% of U.S. office space is convertible to residences profitably.

A flight to quality is likely. Leasers will be seeking high-end office space to motivate workers to show up. “If you’re leasing 30,000 square feet of office space, you may decrease the size but increase amenities.” Expect a flight to the best addresses downtown.

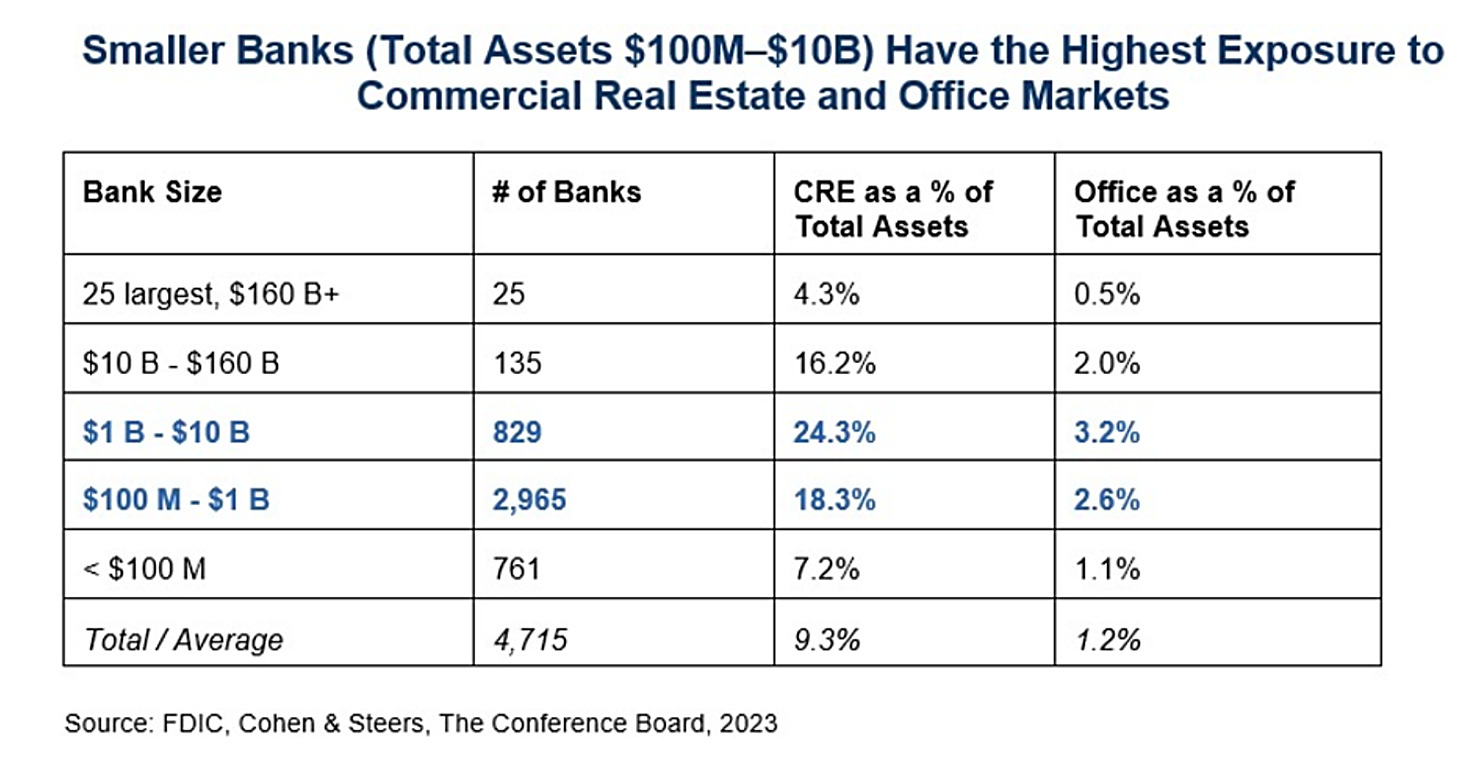

Small and regional banks have exposure. The 25 largest U.S. banks have 4% of their assets in CRE loans, while small and regional banks have about 25% of their assets in CRE. Bank of Ozarks is in Arkansas but heavily invested in New York City office space. Ms. McLaughlin predicted a second leg of the banking crisis experienced in March could be ahead and larger banks will buy smaller banks that are in financial trouble.

“We’ve had a cultural shift in how people work.” Ms. McLaughlin said.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.