Investment Updates

Stocks Dropped Last Week But Data Confirmed Economic Recovery

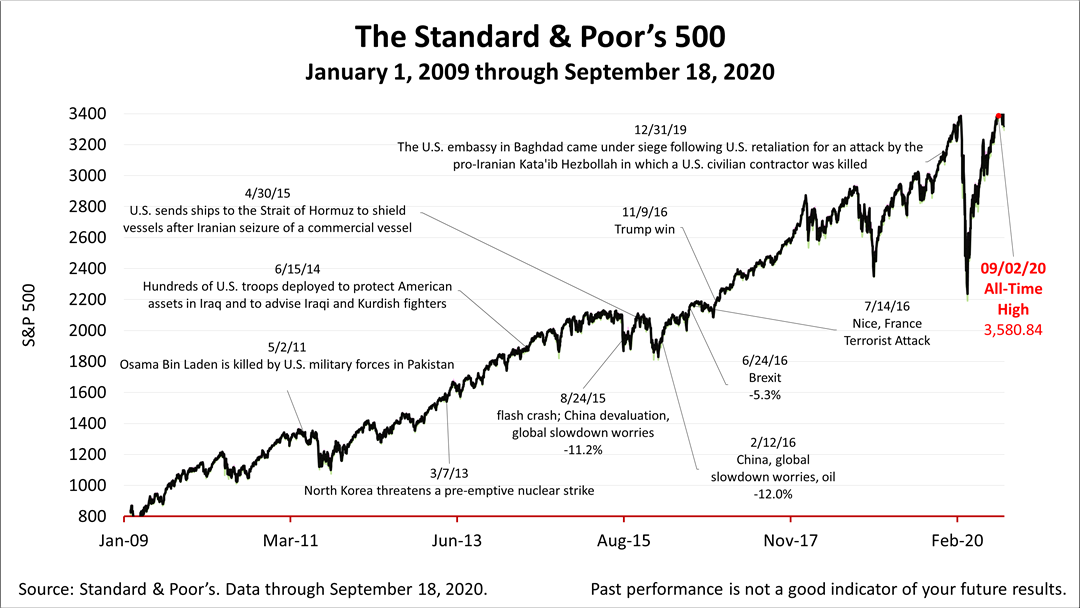

(Friday, September 18, 2020, 8:30 PM EST) Stocks dropped 1.1% today and closed slightly lower from a week ago. It was the third consecutive week that the Standard & Poor's 500 declined, as the U.S. economy's Covid recovery continued but at a slightly less robust pace than had been expected.

The U.S. economy's recovery from the infection is a bit slower and more difficult than had been expected, but the recovery is underway, according to the new data.

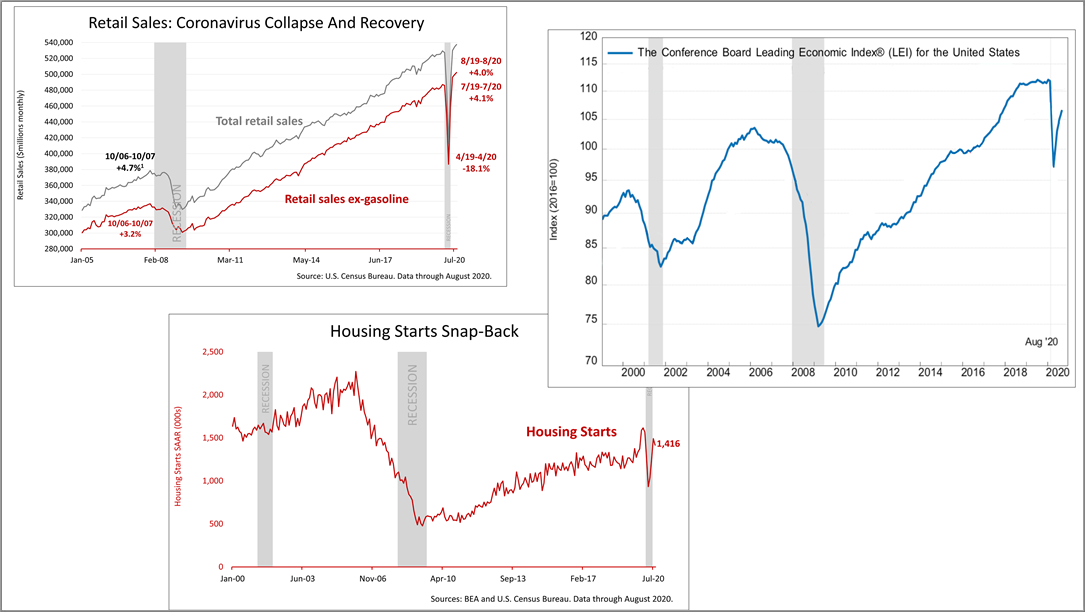

Retail sales, housing starts, and the leading economic indicator index all came in this past week slightly lower than expected. However, they all confirmed the economy is recovering, and that's the main concern if you're investing for retirement, income, or to build wealth for the next generation.

The Standard & Poor's 500 stock index closed down 1.1% Friday at 3,319.47, a loss of -0.64% from a week ago, but +38.94% higher than its March 23rd bear market low.

This marked the third straight week of declines in the S&P 500, and that's the first time this year that has happened, according to Bloomberg Financial News.

The S&P 500 broke its all-time high on September 2, due to a surge in the FAANGM -- Facebook, Apple, Amazon, Netflix, Google and Microsoft -- but they've declined in the past few weeks.

Stock prices have swung wildly since the coronavirus crisis started in March and volatility is to be expected in the months ahead as uncertainty about the shape of the recovery is unlikely to go away.

The Conference Board Leading Economic Index® (LEI) components: 1) average weekly hours worked, manufacturing; 2) average weekly initial unemployment claims; 3) manufacturers' new orders – consumer goods and materials; 4) ISM index of new orders; 5) manufacturers' new orders, nondefense capital goods; 6) building permits – new private housing units; 7) stock prices, S&P 500; 8) Leading Credit Index™; 9) interest rate spread; 10-year Treasury less fed funds; 10) index of consumer expectations.,

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind., and it is subject to change without notice. Any investments or strategies referenced herein do not account for the investment objectives, financial situation or needs of any specific person. The material represents an assessment of financial, economics tax law, and proposals for new taxes, at a specific point in time and is not a guarantee of future results.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Myles wealth management and is not intended as legal or investment advice.

©2020 Advisor Products Inc. All Rights Reserved.

More articles

- Amid A Mixed Week For Stocks, A Strong Recommendation

- Is A Stock Bubble Bursting?

- S&P 500 Breaks Record For A Second Week

- S&P 500 Breaks New Record; Small Business Picture Is Different

- As If Coronavirus Never Hit, Retail Recovers

- Confirming Recovery Is Under Way

- Despite Grim Headlines, Stocks Rose Sharply -- Why?

- The Paradigm Shift In Valuing Stocks

- Retail Sales And Housing Starts In June Reveal Recovery's Shape

- Keeping Perspective In An Unreal Environment

- Economic Fundamentals Recovering As Stocks Surged For the Week

- Stocks Swing Wildly As Economic Recovery Begins

- Dog Days Of Summer In The Economy

- V-Shaped But Full Recovery Is Long Off

- Covid-19 Causes A Good Surprise