Planning Briefs

3Q 2020 Wealth Management Report

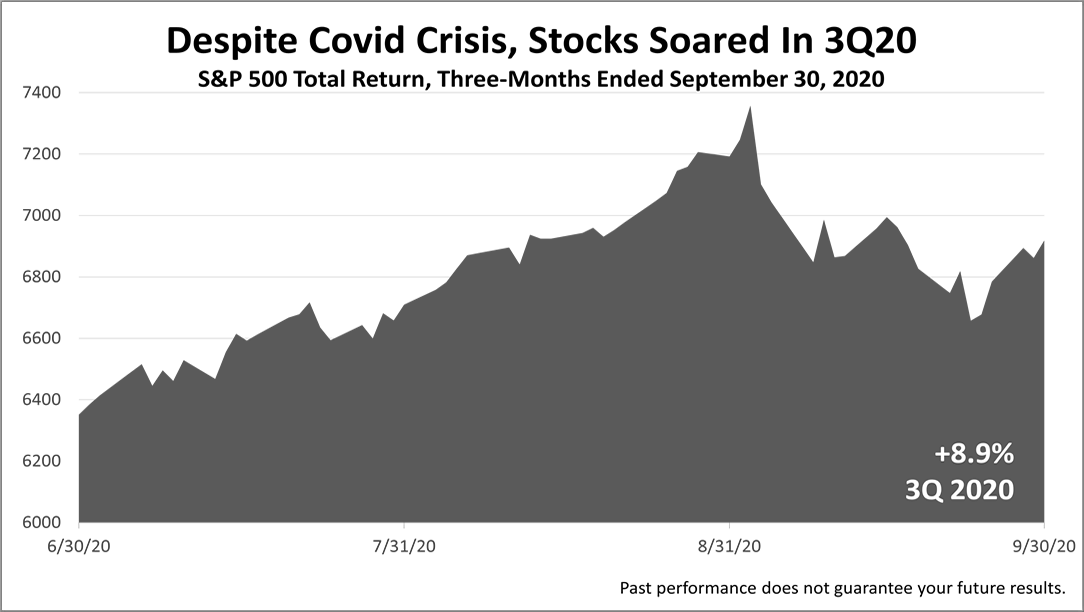

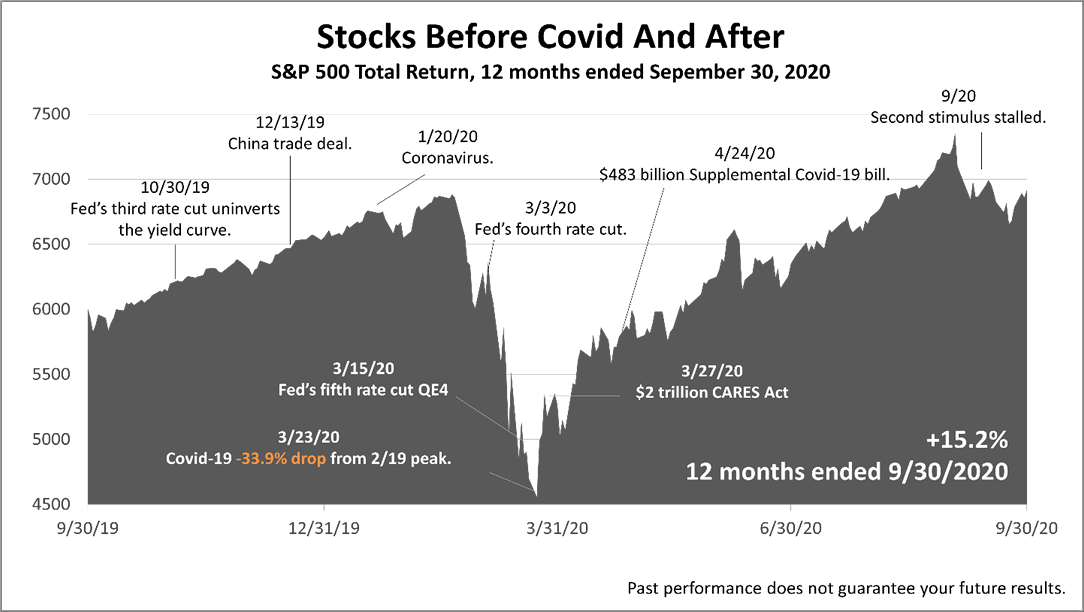

(Tuesday, Oct. 6, 2020; 10:00 PM EST) Stocks posted a +8.9% gain in the third quarter of 2020, following a +20.5% gain in the second quarter of 2020, which followed a -19.6% Covid-related loss in the first quarter of 2020.

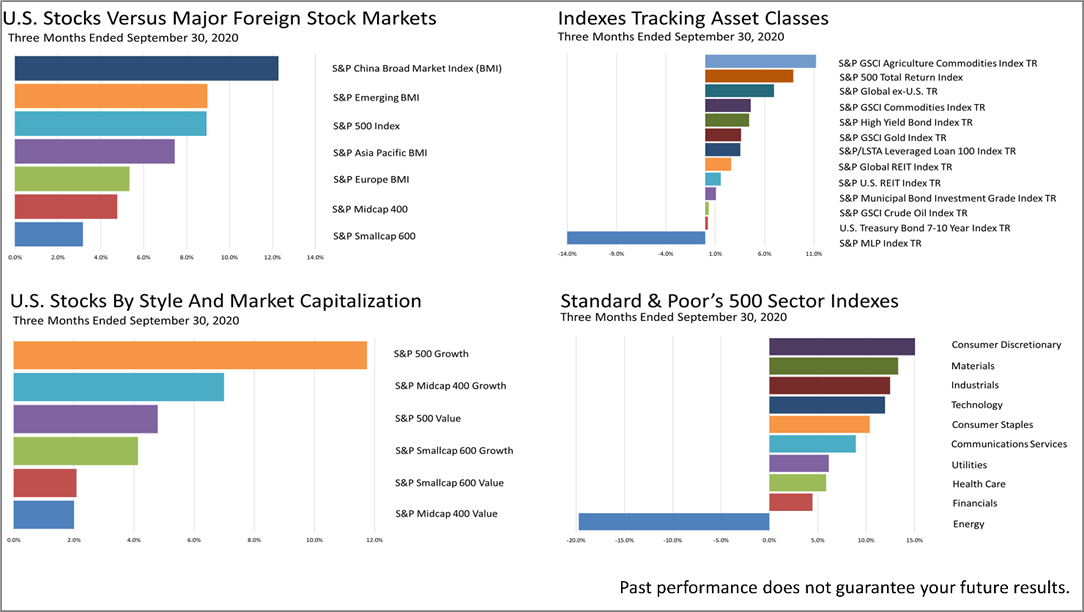

U.S. stocks were the second-best performing of the 13 different asset classes represented here in the upper-right chart.

The Chinese stock market's 33.2% return in the third quarter of 2020 bested major regional foreign markets shown in the upper left. Emerging markets, which are heavily invested in Chinese stocks were the No. 2 performer among major foreign regional stock markets.

Growth stocks led the S&P 500's strong gain.

Stocks had hit an all-time high on February 19, 2020, before plunging 33.9% when the outbreak hit the U.S. Stocks recovered and broke a new all-time high on September 20, 2020 before settling lower at the end of the third quarter.

Keep in mind, stocks are just one part of a diversified portfolio and that the Covid epidemic makes year-end tax planning an urgent priority right now.

For individuals earning more than $400,000 or with a net worth of $5.8 million or more, the likelihood of higher taxes makes tax planning a priority.

While the election results will determine exactly what strategies are best in your personal situation, the expected delay in the results this year makes it wise to begin evaluating your best choices. While managing your portfolio is important, tax planning at this pivotal moment in U.S. tax policy may preserve your assets strategically and action may be required by the end of the year, which makes this an urgent tax alert.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

This article was written by a professional financial journalist for Myles wealth management and is not intended as legal or investment advice.

©2020 Advisor Products Inc. All Rights Reserved.

More articles

- Income, Estate And Gift Tax Hikes Ride On Election Results

- 2020 Year End Tax Planning For Retirees, Business Owners, And Families

- Set Your Financial Priorities Right Now

- Poor Bond Outlook May Herald A New Stock Valuation Regime

- Family Wealth Transfer Opportunities Spawned By Covid

- A Five-Point Covid Diagnostic For Family Wealth Management

- Private Wealth’s Perfect Storm

- Confronting Mortality's Details

- Anomalous Financial Economic Conditions Of The Covid Crisis

- Three Easy Ways To Increase Your Chance Of Financial Success

- Act Before The Tax Pendulum Swings Back

- Act By The End Of 2020 For A Major Retirement Income Tax Break

- Business Owner Alert: Main Street Lending Program Offers Covid Aid

- Financial And Tax Planning For The Long Run

- A Constellation Of Facts Squarely Aligns With 2020 Roth IRA Conversions